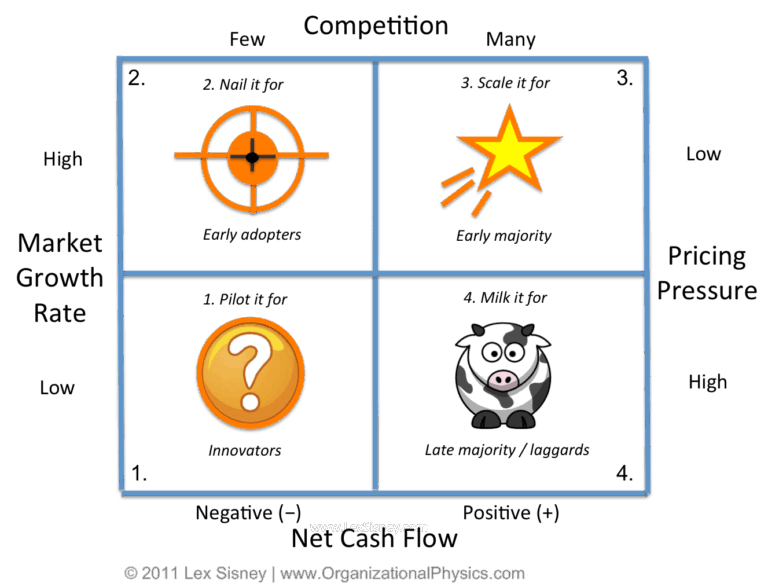

The Stages of the Execution Lifecycle

When It Comes to Strategic Execution, Sequence Matters Summary Insight: Most companies stall or die because they misalign their org with the stage of growth. This article gives you the execution roadmap—and the forces you need to scale without breaking.