Every Strategy Has the Same Goal

Summary Insight:

Strategy isn’t about buzzwords or tactics. It’s about extracting energy from your environment faster and better than anyone else—and adapting before the well runs dry.

Key Takeaways:

- Strategy is energy acquisition—money, resources, and clout—from your ecosystem.

- Adaptation beats fitness; alignment trumps effort.

- The best strategy: unique capabilities matched to growing opportunities.

Every potential business strategy has the same ultimate aim. This is true whether you are trying to sell your business, go IPO, enter a new market, raise venture capital, hire top-notch talent, fend off competitors, manage increasing regulations, win an industry award, or create the next hot startup. It doesn’t matter what the strategy is — the goal is always the same. This goal is also independent of time or context. It’s just as true in recessionary times as it is in boom times. It was true one million years ago and it will be true one million years from now. So what is this goal of strategy?

The ultimate goal of any strategy is to acquire new energy from the surrounding environment now and in the future.

The evidence for this comes from the most fundamental tenet of evolution: adaptation. Before we continue, let me clear something up about evolution. When most people think of evolution they think of Darwin. And when people think of Darwin, they usually recall the term “survival of the fittest.” However, Darwin himself never used that term. Well, that’s mostly true … Darwin only used the term late in his life to refute the notion that success goes to those most fit. Instead, what Darwin made clear is that survival (and prosperity for that matter) goes to those most adapted to their environment. If there’s good adaption or integration with the environment, then the species will flourish. But if the environment changes and the species can’t adapt, it will fail. That’s why you’re reading this – and not some brontosaurus.

Why is adaptation with the environment so important? Because that’s where new energy comes from. Without new energy, a system will perish. For example, if a man is stranded on a desert island, unless he can find new sources of energy like food and water, he’s quickly going to die. Just like a business with no new sales will quickly die.

In Organizational Physics, “energy” is simply a measure of available or stored power. In a business this includes all forms of available or stored power including money, resources, and market clout. Basically, a good definition of energy is anything useful and desirable that can be made productive. In fact, begin to think of your business as an energy conversion system. For example:

• Money is really just a form of stored energy. It’s used to make the exchange of products and services (other forms of stored energy) more efficient. But money is just a tool. If one business wanted to trade its pigs for some cows in barter, both the pigs and cows would be similar energy sources too.

• Resources include power sources that the organization has available to itself, including the stored energy potential of the people, materials, natural resources, know-how, and capital equipment involved. Obviously, every organization needs resources to be successful.

• Clout is the influence and good will that the organization has built up over time. Every business needs clout. Great companies nurture and defend the clout of their brand because they know that if they lose it — for example, if consumers lose trust in the brand — then they’ve lost a critical asset or energy source.

Evolution shows us that if the environment has no more energy to give (if the resources are tapped out) and if the species can’t adapt, it will fail. Or, if the species can no longer extract available energy from the environment and if it can’t adapt, it will fail too. This will happen if its capabilities are no longer suited to the environment or the competition is too great relative to the size of the opportunity (this is where survival of the fittest comes in).

The same principle holds true in business strategy. If your company is operating within a growing market opportunity where there’s a lot of customer demand (i.e. there are a lot of potential new energy sources in the form of money, resources, and clout) and if it can efficiently meet that demand, then it will be successful. But if the market needs change, then the company must adapt to meet those needs or it will cease to exist too. The secret to business strategy, therefore, is to use your capabilities to find and maintain integration with growing market opportunities so that your business can get plenty of new energy (money, resources, and clout) now and in the future.

To drive the point home that a successful business is one that efficiently extracts energy from its environment, take a look the top three U.S. companies by market capitalization on October 7, 2011: Exxon (XOM), Apple (APPL), and Microsoft (MSFT). Notice what they all have in common. Each, in its own way, has successfully created its own “ecosystem” to extract more available energy from the environment than its competitors.

Exxon for example, owns or controls every aspect of petroleum production. It owns the wells, the pipes, the refineries, the trucks, the ships, the mineral rights, and the retail distribution. It’s capable of extracting more dollars, resources, and clout out of the petroleum industry than any other competitor. You may hate Exxon as a company but there’s no denying that they are extremely effective and efficient at what they do and their market cap reflects that. Of course if the environment changes — if all the oil and gas runs out, if new green fuels become practical alternatives, or if the the planetary environment changes radically enough from carbon emissions, Exxon will need to adapt or perish. And it must start adapting before it’s too late.

Apple is the same way. Notice how with iTunes, iCloud, iPhone, iPad, MacBooks, and its App Store, as its online and retail distribution channels, it easily extracts new energy from its ecosystem. Once you have an iPhone, you’re now “locked into” the ecosystem and conveniently buy apps from the App Store. If you reflect back on just a few years ago, Apple was out of cash and low on hope while Microsoft was the world’s dominant company. Of course Microsoft built its empire in the 1980s around an ecosystem of desktop computers and the software that runs them. And notice, too, how Microsoft ate Apple’s lunch for many decades but now Apple’s returning the favor. What happend? The environment changed! Apple has become better adapted to today’s environment of elegant design and mobile devices while Microsoft has not been able to adapt.

What About Survival of the Fittest?

This question comes up often enough that I want to address it now. Survival of the fittest is certainly important. It is a measure of how fit an organization’s capabilities are in extracting available energy from opportunities in the environment. For example, imagine two leaders. One is an aboriginal chief in Australia. The other is an executive at Lehman Brothers. Who is the most fit? It depends on the environment. If the banker is stranded in the outback, there’s lots of opportunity to survive and flourish but he just doesn’t have the capability to execute. The aboriginal chief, on the other hand, can enjoy a good life if left in the wild because he’s more fit for that environment. Back in New York, if the environment changes, for example if there’s a financial collapse, the banker’s skills will no longer useful and he or she will need to adapt to new conditions. Adaptation to the environment is supreme and fitness or capability is always secondary.

Not All Capabilities and Opportunities are Created Equal

To get new energy from the environment, a business must use its capabilities to find and integrate with opportunities in the environment. For example, a dentist’s office has capabilities in teeth cleaning and repair, front office administration, marketing, etc. In the surrounding environment are opportunities — people who have cavities or who want a whiter smile and healthy gums. If the dentist office can use its capabilities to attract customers to its practice and produce positive and desired results for them, then those clients will give energy (money) in return. If the dentist is really good, if he or she is able to produce positive and desired results consistently, then it will be easier to get those clients to return and send their friends (more sources of energy). The same holds true for Apple, Microsoft, and Exxon, as well as for a cheetah on the plains of Africa. Success is about aligning capabilities with opportunities.

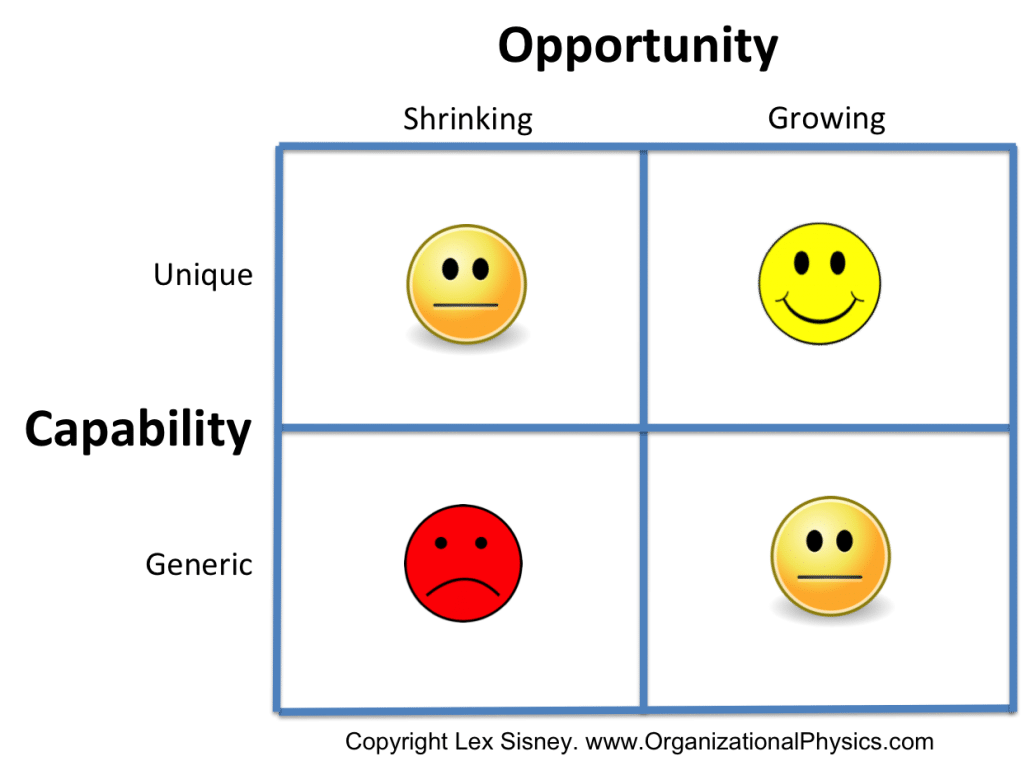

However, it should be readily apparent that not all opportunities and capabilities are equally valuable. Opportunities exist on a spectrum of growing to shrinking, while capabilities exist on a spectrum of unique to generic.

Best: Unique Capabilities with Growing Opportunities

The best strategy is to align unique capabilities with a growing market opportunity, now and in the future (upper right quadrant). If the organization can do this, it will have a very high probability of being successful. Why is this? Well, a growing opportunity means there’s a lot of market demand and new energy sources available. At the same time, the organization has developed unique capabilities where there are few real or perceived practical alternatives.

Let’s go back to Apple for a moment. As I mentioned before, there’s a growing market need for people to be mobile, connect with others, and have access to media and information at their fingertips. There’s a big need and thus a big opportunity. And Apple has developed capabilities in vision, execution, product design, integrated hardware and software, global supply chain management, marketing and branding, and so on. Because Apple’s capabilities are aligned with the current market opportunity (and because there are few practical alternatives to what Apple provides and how well they do it), Apple is incredibly successful right now.

Tolerable: Unique Capabilities with a Shrinking Market Opportunities

A less successful strategy is to align unique capabilities with a shrinking market opportunity (upper left quadrant). If you own a market or operate a real or effective monopoly, you can still be successful for as long as the market demand holds. The movie rental chain Blockbuster is a good example. They had unique capabilities in movie aggregation and distribution. Even though people were renting fewer and fewer movies, they were able to hang on and be successful for a time. However, environments can change very quickly, as we saw with the shift from rental tapes and dvds to online delivery. Even though Blockbuster had a near monopoly in video rental stores, they went bankrupt because the demand shrank so rapidly. Netflix has been better adapted to the new world of online delivery. But notice too how they’ve been getting a lot of negative publicity lately for their attempts to serve a dwindling market opportunity (people who still want hard disks in the mail) versus a growing market opportunity (people who want to watch what they want instantly online). Netflix knows, just as Blockbuster knew, that they have to make the leap to serve this new, growing market segment or they’ll perish. I’ll explain how you can make this shift later in this series.

Tolerable: Generic Capabilities with Growing Market Opportunities

Another less effective strategy that the first I mentioned is to serve a growing market opportunity with generic capabilities (lower right quadrant). Just like the last strategy, you can make this one work for a time one but it’s not nearly as fun and lucrative as having unique capabilities in a growing market. For example, imagine a family doctor who runs his or her own practice. Health care is a growing market. The doctor has capabilities to diagnose and treat disease. He or she may even be an incredibly talented practitioner with an empathetic bedside manner and a sincere desire to see his or her patients get well. So what? The doctor still struggles to earn a living and pay the bills. Why? Because the market (including customers, vendors, and the insurance industry) views the doctor as just one of thousands of practical alternatives to choose from.

It’s important to point out that it doesn’t matter how unique you think your capabilities are. It’s how the market perceives your capabilities that matters. If there are a lot of perceived practical alternatives, it’s harder to be successful. That’s why in crowded industries the most successful practitioners are those who specialize in one particular discipline. The best brain surgeon for meningioma or the best realtor for high-end homes in 90210. Businesses that successfully differentiate themselves create the perception of unique capabilities and have an easier time of it. That’s why advertising was created. Companies use advertising to try to differentiate themselves from other practical alternatives in the marketplace. To call out what makes them unique and why the market should care. That’s why in a crowded marketplace, the more narrow your focus is, the broader your appeal. And that’s why the saying “perception creates reality” is so poignant. Because it does.

Terrible: Generic Capabilities with Shrinking Market Opportunities

The least successful strategy by far is to be in a shrinking marketplace with generic capabilities (lower left quadrant). If this is you, then you are suffering and you will continue to suffer. There is an ever-decreasing amount of available energy in the marketplace. There’s a free-for-all in competition who fight for the scraps. It’s truly a dog-eat-dog world. Adapt or perish. For example, I knew lots of real estate agents in Santa Barbara during the boom. The environment changed during the bust. Most of them wisely left the industry and attempted to transition their capabilities (sales, networks, contract negotiations, etc.) into other growing industries where there’s greater opportunity. Others who have stuck with it have done so by focusing on a niche: “I’m the foreclosed property specialist” or “I have over 25 years’ experience successfully selling Montecito estates. I’ve been here through booms and busts and I’m you’re agent!”

The Challenge and Opportunity

To recap, the goal of any business strategy is to get new energy from the surrounding environment, now and in the future. The obvious challenge to maintaining integration between unique capabilities and growing market opportunities is the fact that the organization, its products and services, as well as the market conditions are constantly changing. As Darwin made clear, adapting to change can be a life or death struggle. It’s hard to anticipate change, to understand its ramifications, and to adapt in the right timeline and sequence. It’s challenging to acquire enough resources in capabilities, time, energy, and money to adapt successfully. It’s difficult to prioritize between the immediate needs of today and investing in the future.

Don’t underestimate the difficulty of adapting. It is a big challenge indeed. In spite of this, it’s possible and it happens all the time. The name of the game in strategy is keeping your organization tightly integrated with growing opportunities, now and in the future. If you can convert that available energy profitably and make it productive, then you’ll be very successful.

There is a key insight that makes adapting to change and executing the right strategy more attainable. It’s this: all systems evolve in a particular pattern called a lifecycle. By learning to recognize the lifecycle stages of your organization, its products, and the market (as well as the different sets of milestones, challenges, and metrics of each), you can correctly adapt your strategy, in the right time and sequence, and improve your probability of success. We will discuss how to do this in the coming sections.

Back to Tutorials.