Yahoo is in the news this week because the board just hired Marissa Mayer away from Google to be its new CEO. Mayer, who by all reports is highly intelligent and creative, excels as a product visionary. Yet not surprisingly, short-term value investors are upset about this hire. This is because they want Yahoo to focus on cutting costs and milking the company for cash until a strategic buyer can be found. So who’s right and what’s the best strategy for Yahoo? Before I answer, let me explain how we can answer this question.

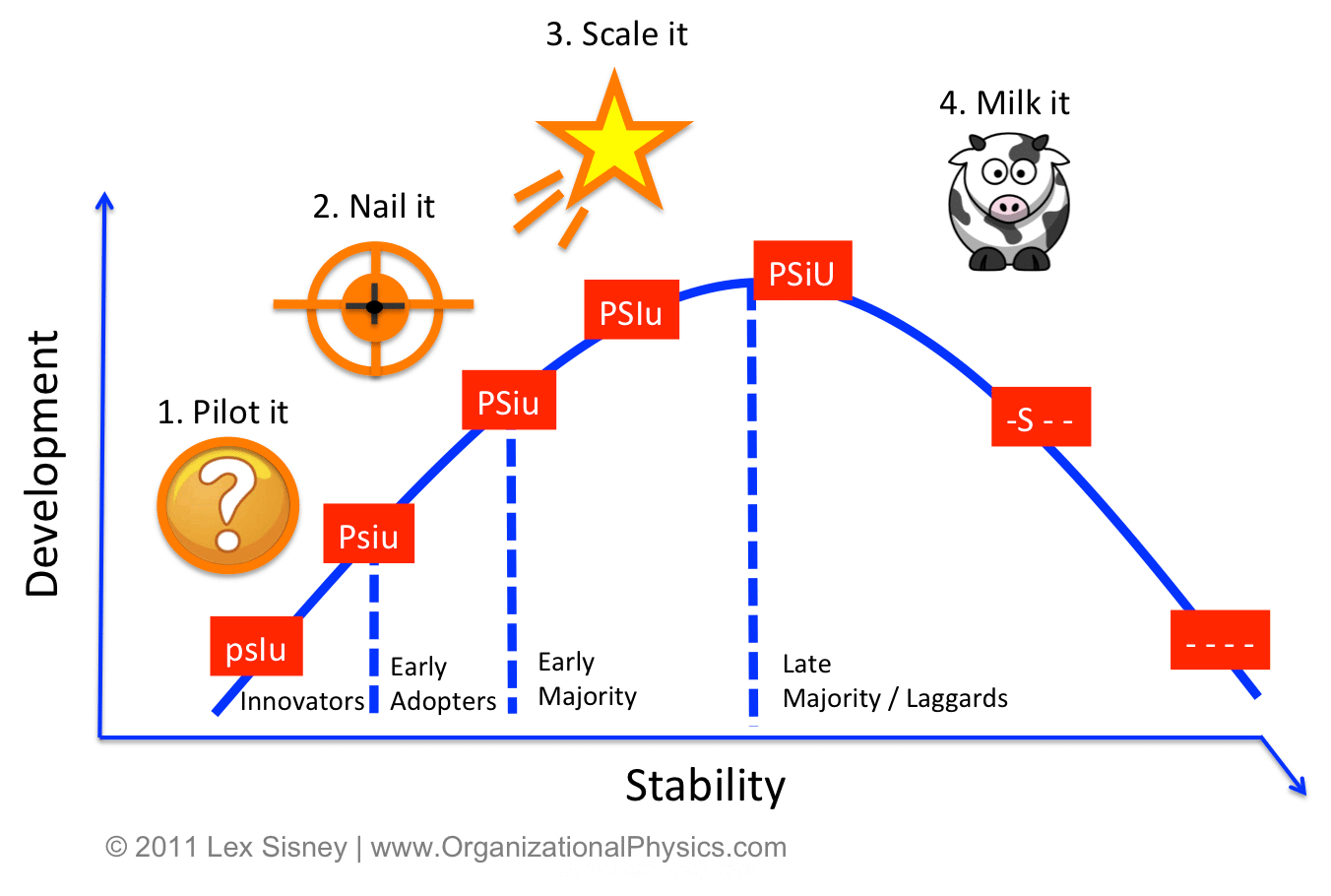

In Organizational Physics, we use a simple code called PSIU to tell what’s right, what’s wrong, and what to expect from situations or decisions. Like DNA, PSIU explains why things “show up” the way they do. It can be used to understand individual styles, analyze organizational design, and even to anticipate organizational problems well in advance of when they occur. PSIU can also be used to understand and design a business strategy in a simple, elegant, and effective way.

Effective strategy design starts with a simple premise. Play to your strengths. What is your organization exceptional at? Basically, a business can have a strategy that capitalizes on:

• Better customer service than its competitors (P)

• Cheaper costs than its competitors (S)

• Higher innovation than its competitors (I)

• Stronger organizational culture than its competitors (U)

No single company can be the best in all four. Why? Because any given strategy consumes finite time and energy. It’s expensive and time consuming to invest in any given track. Great companies recognize where they will place their focus and what they will sacrifice.

For example, Zappo’s focuses its strategy on having a stronger organizational culture (U) and providing better customer service (P) than its competitors. They’ve done a great job of using those strengths to their advantage so far. Can you get cheaper shoes (S) elsewhere? Yes!

Amazon (which owns Zappo’s and seems to allow it to operate autonomously), on the other hand, focuses on providing the lowest cost (S) possible and providing great customer service (P). Is Amazon an example of great organizational culture (U)? Not according to insiders.

Walmart excels at delivering cheaper costs (S) than the competition. But notice that Walmart doesn’t also focus on providing a personalized shopping experience (P) or showcasing the most innovative hot new fashions (I) like a small boutique store must do. Nor is it recognized for having a great organizational culture (U). You can’t be all things to all people. Don’t even try.

In order to make sacrifices to play your strengths, you must first and foremost understand what’s happening in the environment. What type of industry do you operate in? Is it growing or aging? Are your current strengths still relevant and will they be relevant in the future?

Let’s take the internet advertising industry as an example. In the mid 2000s, this industry went through its first round of consolidation. Now it’s in a period of rapid innovation again. If you want to keep pace in this industry, you should be investing in innovation (I) too. Could you attack this industry with cheaper solutions (S) or better customer service (P)? Only for as long as your solutions are still relevant.

Compare this to the US healthcare sector. On the one hand, there’s lots of talk about new innovations (I) in healthcare. On the other hand (and I know this from consulting for several innovative companies in the space), the entire industry moves at a snail’s pace (S). If you’re operating in the healthcare field, you should expect to run up against bureaucracy, powerful vested interests, and a great attachment to the status quo. Things are going to move much more slowly than you’d like and your company will be in for a long, drawn-out fight, not an overnight sensation.

Now back to Yahoo. If we follow the PSIU code, we can tell that the internet industry itself is in rapid innovation mode (I) and this will continue for a long time to come. If Mayer can lead Yahoo to reinvent itself to attract creative talent once again and drive forward the next wave of innovation, then it can capitalize on this macro-trend and be relevant once again.

But notice that innovation (I) costs a lot of money. It takes risks, it takes talent, it takes flexibility, and it takes a long view of change. These are all things that short-term value investors hate. Can Mayer fight against this short-term pressure and make Yahoo innovative again? I’d bet against it for three big reasons:

- It’s incredibly challenging to turn any company around – especially a company that is operating in a highly innovative space and is behind the curve. Steve Jobs did it but he had several things going for him: He had already been a CEO of two companies (Apple and Next) and by the time he took over Apple again, he was incredibly seasoned. Also, Apple didn’t have to re-invent what it did, it just had to do it better. In hiring Mayer, by contrast, Yahoo is rumored to be trying to change a media company into a technology/product company – and that’s a very different animal. And then, we must recognize that Steve Jobs – well, there simply aren’t too many of him around.

- When a company is growing like a rocket, like Google, everyone looks like a genius. Like Woody Allen said, “80% of success is showing up.” Well, if you’re showing up each day and the company is growing 10,000%, then there’s a halo effect that follows everyone around. Was Mayer the real driver of that growth or a beneficiary of that growth? Even Eric Schmidt, the former CEO and current Chairman of Google recognizes this when he told Sheryl Sandberg, the COO of Facebook, “Don’t be an idiot. Get on a rocket ship. When companies are growing quickly and they are having a lot of impact, careers take care of themselves. And when companies aren’t growing quickly or their missions don’t matter as much, that’s when stagnation and politics come in. If you’re offered a seat on a rocket ship, don’t ask what seat. Just get on.”

- Yahoo is something of a clusterf**k right now and is suffering from very, very high internal entropy. Mayer is the seventh CEO in five years. It’s hard, in a place like that, to make decisions, implement them fast, and gather the mass of conflicting objectives. Not only does the strategy have to be right; it has to fight through internal entropy to execute quickly. In addition to Yahoo’s high internal entropy, Marissa is recently pregnant. Now I’m NOT saying that CEOs shouldn’t get pregnant. I just want to call out that having a baby is both a blessing and a high-entropy event in the life of a family. Mayer is obviously going to have a ton of support from her husband and professional caregivers – but even with a ton of help, it takes a tremendous amount of energy to have a new baby in the house. The sleepless nights, the emotions, the feedings, all of it – the baby is its own Yahoo and requires just as much love, care, and attention to help it grow. So Mayer’s energy and focus are naturally going to be split in the most critical early time of her transition into Yahoo.

All that said, I’d love to be proven wrong about Yahoo and Mayer. If Yahoo can afford to work toward the long-range view and invest in creating experiences that consumers love once again, then Mayer may indeed be a good choice. In any case, the terms of the upcoming battle are clear and it will be interesting to watch it unfold.

If you want to learn more about how to think about strategy, and you’re interested in a full strategy assessment and roadmap for your own business, you’ll want to read Part III of my book Organizational Physics – The Science of Growing a Business. You’ll learn to better understand your current strengths; analyze the industry, trends, and competition; and then design a powerful strategy for the future.