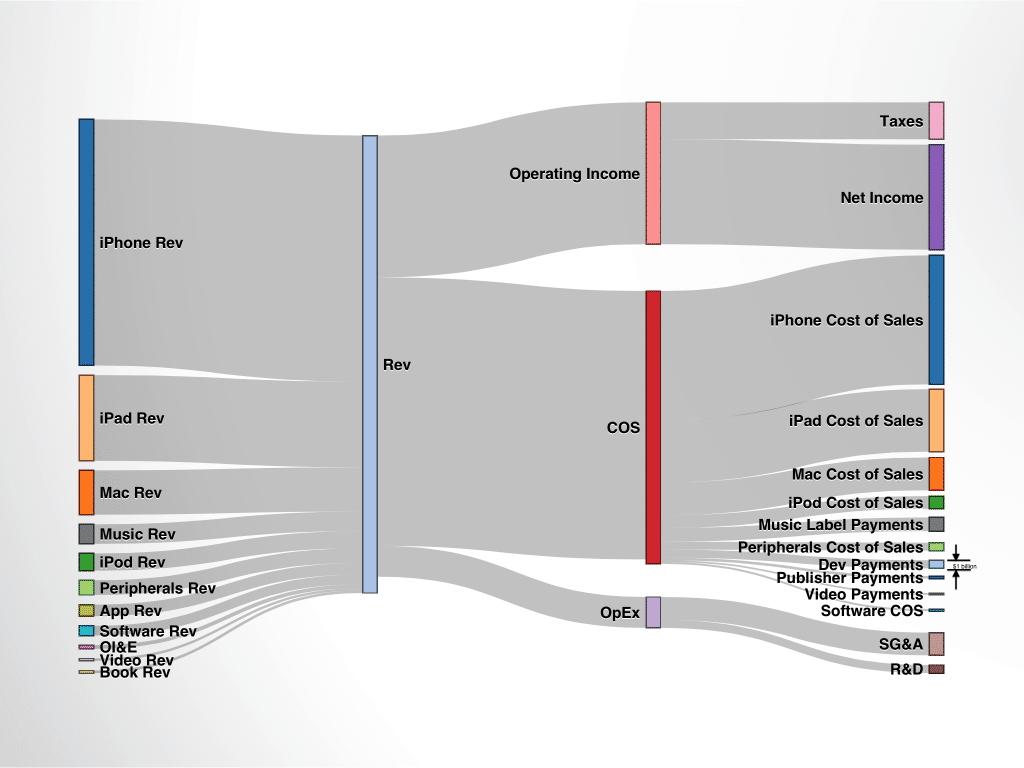

Data is for Q4 2012. See Asmyco.com for source and notes.

Two things that I love about this chart:

- First, it’s just a great visual representation. All data should be so beautiful.

- It reflects how Apple truly is an ecosystem company. Note that even though the revenue of hardware sales dwarfs the combined sales of digital services (i.e., music, apps, and software sales which are still huge in their own right), it is these digital services that extend the Apple ecosystem and make it large and vibrant. And of course, the larger and more vibrant the ecosystem, the more value it creates.

You can see the same “ecosystem economics” in another great brand — Amazon. Both Amazon and Apple are in the business of getting customers into their ecosystem by creating value to customers, and then consistently reducing the friction for new transactions to occur.

Once you buy a Kindle, or sign up for Amazon Prime, there’s very low friction for you to make future purchases (i.e, it’s easy for Amazon to extract new energy in the form of money, brand clout, and capabilities from its surrounding ecosystem). And just like a Lion prefers hunting grounds with lots of Antelope, the more digital services each brand offers, the more consumers desire to be a part of that ecosystem.

Keep this concept in the front of your mind when you’re scaling your own business — think in terms of creating ecosystem economics around a core value proposition where there’s low transaction friction and high customer engagement over time. Don’t be a product company. Be a systems company.